New York Cannabis Regulations – Are You a True Party of Interest?

As the New York State Office of Cannabis Management (“OCM”) has started accepting applications for the adult-use cannabis market, it is important to be aware of certain ownership requirements. The New York State Cannabis Law (the “Regulations”) creates a framework that distinguishes between certain individuals with an interest in supply tier entities and those with an interest in retail tier entities. The framework incorporates, and the ownership requirements are largely dictated by two concepts, the first being a True Party of Interest and the other being whether a person is a Passive Investor or has a Financial Interest. This article will provide an overview of how these ownership concepts tie into the structural framework that the OCM has created.

Supply Tier vs Retail Tier

The Regulations created two types of entities, Supply Tier entities and Retail Tier Entities. Supply Tier entities include entities seeking a license to operate as a (i) nursery, (ii) cultivator, (iii) processor, (iv) distributor, (v) cooperative, (vi) microbusiness, and (vii) registered organization. Retail Tier entities include (i) dispensaries, (ii) on-site consumption licensees, and (iii) delivery licensees. If a person has an interest in a licensee that is a Supply Tier entity, that person cannot hold any interest in a Retail Tier entity, and vice versa.

True Party of Interest, Passive Investors, and Financial Interests

It is extremely important to be aware and understand who a True Party of Interest is. A True Party of Interest (“TPI”) is a person who has an interest in a cannabis license. TPI’s include any person who:

- is a sole proprietor, partner, member or manager of a limited liability company, shareholder of a licensed entity, or the spouse of any of the foregoing;

- exercises control over a licensee, including management services providers;

- holds an actual or future right to ownership or investments (or the spouse of someone who holds such right), including by stock, convertible instrument, option, SAFE, or equity swap agreement in a licensee;

- serves in a leadership, senior, or control position (or the spouse of someone who holds such right);

- receives aggregate payments in a calendar year that exceed the greater of (i) 10% of gross revenue, (ii) 50% of net profit, or (iii) $250,000 (the “Payment Rule”);

- assumes responsibilities for the debts of a licensee; or

- makes up (or is the spouse of someone who makes up) the ownership structure of each level of ownership of a licensee that has a multilevel ownership structure.

Importantly, a TPI has “Control” over an entity if the TPI has the authority to order or direct the management, operation, managers, or policies of an entity.

Passive Investors

A Passive Investor is a TPI of a licensee who owns (i) 5% or less of the outstanding shares or interest of an applicant or licensee that is publicly traded, (ii) 10% or less of the of the outstanding shares or interest of a non-publicly traded registered organization with dispensing licensed or microbusiness licensed entity, or (iii) 20% or less of the outstanding shares or interest of any other entity. Additionally, a Passive Investor is any person who guarantees a lease.

Financial Interests

A person has a Financial Interest in an entity when the person has any actual, or future right to, ownership in an entity. This includes via compensation arrangements if the arrangement results in compensation exceeding the Payment Rule thresholds. Importantly, a person with a Financial Interest does not include a Passive Investor or salaried employee earning income in excess of the compensation limits. Additionally, when a person’s ownership in an entity is being calculated, it is calculated as the greatest of the person’s share of (i) current voting interests, (ii) future voting interests, (iii) current equity interests, or (iv) future equity interests. This calculation factors in the entire ownership structure.

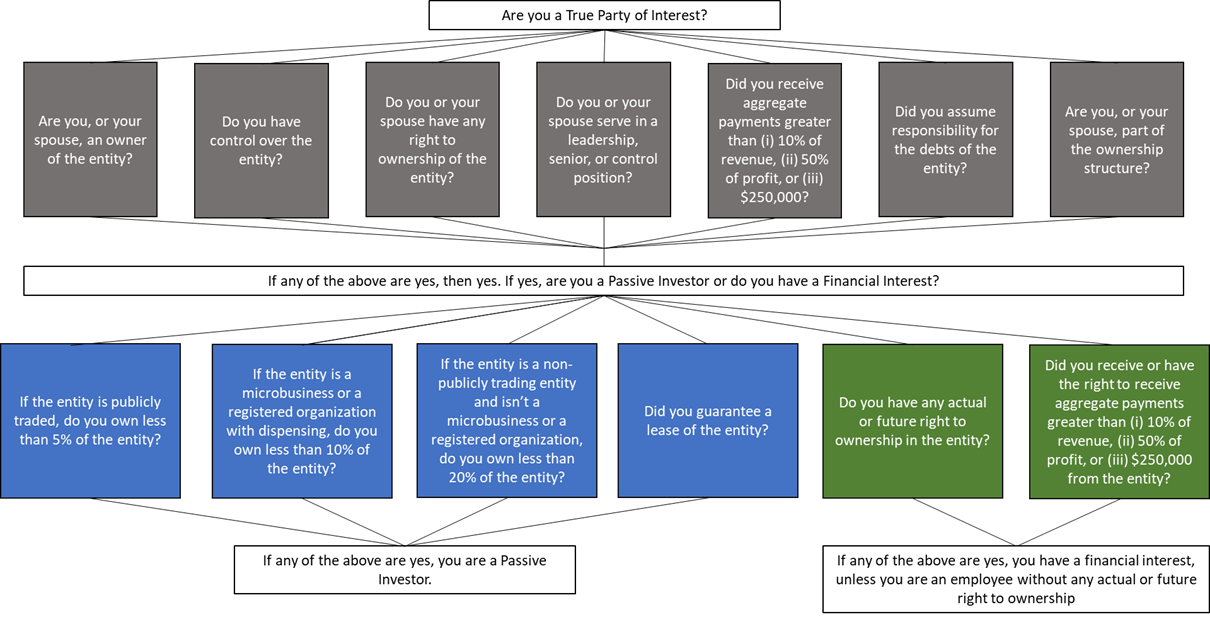

Below is a flowchart to help you identify whether you are a TPI and whether you are a Passive Investor or have a Financial Interest. Once you are aware of your TPI status, you can then better assess which restrictions apply to you.

Restrictions

The Regulations create the restrictions for TPIs with respect to adult-use cannabis licenses. On a high level, a TPI cannot have an interest in both a Supply Tier entity and a Retail Tier entity. However, these restrictions go beyond just Supply Tier and Retail Tier distinctions to detail the following restrictions:

- A TPI in an adult-use licensee cannot have any interest in a non-adult-use licensee

- A TPI can only have a Financial Interest or Control in one licensee that includes cultivation

- A TPI cannot be a TPI in both a microbusinesses and distributor

- None of a nursery, processor, or microbusiness can have more than one license of the same type

- A microbusiness cannot be a TPI in any other licensee of any type

- A TPI in a retail dispensary cannot have a Financial Interest or Control in any on-site consumption entity

- A TPI in an on-site consumption entity cannot have a Financial Interest or Control in any retail dispensary entity

Subject to the above restrictions, there are some permitted ownership structures. First, a TPI can be a TPI in an unlimited amount of non-cultivation Supply Tier licenses. Second, a TPI in a retail dispensary can have a Financial Interest or Control in up to three retail licensees and be a Passive Investor in unlimited Retail Tier entities. Third, a TPI in an on-site consumption entity can have a Financial Interest or Control in up to three on-site consumption entities and be a Passive Investor in unlimited Retail Tier entities. Finally, if an applicant is the owner of a Retail Tier entity in another state, the applicant is allowed to own Retail Tier or Supply Tier entity in New York.

There are many issues to consider when determining whether to apply for a cannabis license, and which type of license to apply for. The above is strictly a high-level overview of some of the ownership regulations that the OCM has detailed. Structuring requirements are not the sole issue or deciding factor when applying for a license, but are rather one of the many requirements that the OCM has outlined in the Regulations. There are certain structuring solutions that can be implemented to help applicants comply with the ownership restrictions. These are subject to changes and updates, and you should consult legal counsel prior to submitting any application to ensure that you meet the structuring requirements for the license you seek.

No aspect of this advertisement has been approved by the highest court in any state.

Results may vary depending on your particular facts and legal circumstances.

As the law continues to evolve on these matters, please note that this article is current as of date and time of publication and may not reflect subsequent developments. The content and interpretation of the issues addressed herein is subject to change. Cole Schotz P.C. disclaims any and all liability with respect to actions taken or not taken based on any or all of the contents of this publication to the fullest extent permitted by law. This is for general informational purposes and does not constitute legal advice or create an attorney-client relationship. Do not act or refrain from acting upon the information contained in this publication without obtaining legal, financial and tax advice. For further information, please do not hesitate to reach out to your firm contact or to any of the attorneys listed in this publication.

Join Our Mailing List

Stay up to date with the latest insights, events, and more